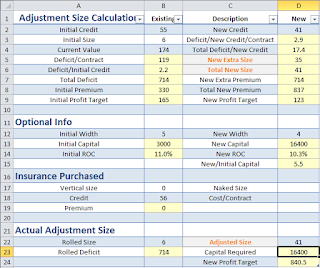

I used a spreadsheet to calculate my entry, stop and target points, as well as the reward to risk ration as shown below. In the end, this pattern failed and I sold the put at $1.2 after SPY gapped up on July 13. The insurance loss was $174 x 2 = $348. Thus the July SPY position had a minor loss $12 (=348 - 6 x 56) after SPY puts expired worthless yesterday.

Short Stock

|

Price

|

ATR

|

2.19

|

Swing low/Breakout

|

205.28

|

Resistance

|

208.02

|

Trade Trigger

- Below prior day low by 10% ATR |

205.061

|

Entry limit order

- Buy stop limit at 10% ATR below trigger |

204.842

|

Initial Stop

- Sell stop market is higher value of (1) 0.1 ATR above resistance, (2) Trigger price + ATR |

208.239

|

Price to set break-even stop

- equal Entry limit - (Initial Stop -Buy stop limit) - Drop new BE stop after a new swing high of 5 days+ is made |

201.445

|

Target

- Lower horizontal support - Range % within down trend line in last 5 weeks - Sell half & Trailing another half at 0.1 ATR above prior swing high or break-even - Sell last half at new target based on new pattern or larger time pattern (whichever is closer) |

198.5263

|

Reward/Risk ratio

- Must be greater than 2 |

1.8592028

|

Short Stock

|

Price

|

ATR

|

0.58

|

Swing low/Breakout

|

17.03

|

Resistance

|

17.91

|

Trade Trigger

- Below prior day low by 10% ATR |

16.972

|

Entry limit order

- Buy stop limit at 10% ATR below trigger |

16.914

|

Initial Stop

- Sell stop market is higher value of (1) 0.1 ATR above resistance, (2) Trigger price + ATR |

17.968

|

Price to set break-even stop

- equal Entry limit - (Initial Stop -Buy stop limit) - Drop new BE stop after a new swing high of 5 days+ is made |

15.86

|

Target

- Lower horizontal support - Range % within down trend line in last 5 weeks - Sell half & Trailing another half at 0.1 ATR above prior swing high or break-even - Sell last half at new target based on new pattern or larger time pattern (whichever is closer) |

14.08381

|

Reward/Risk ratio

- Must be greater than 2 |

2.6851898

|