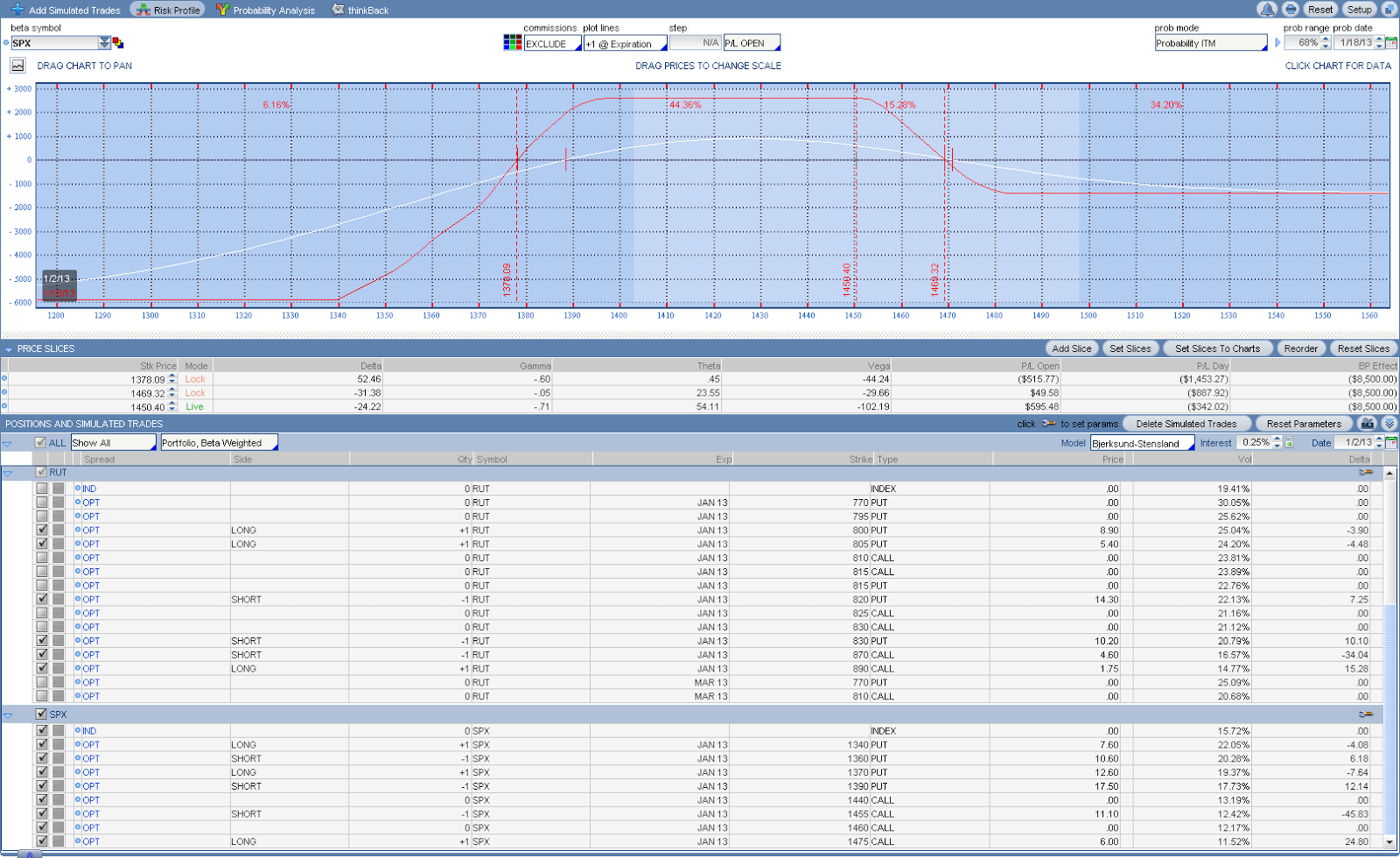

This morning, the market continued to show a bullish bias by starting low and climbing higher, a frequent pattern these days. Even though there is a high probability of a market pullback in the next few days, my portfolio Delta has reached an uncomfortable level of -98 and the P&L chart shows price reaching the right edge again. So I decided to make adjustments to reduce potential risks. This time, the most offending position was RUT as shown below.

With 16 days to Feb expiration for the index, I decided to close the most damaged IC, then added a couple of double calendars with slightly different centers. To make the new P&L chart smoother, I also added a single calendar position to the left side of the chart. After these adjustments, the RUT position returned to the center as shown below. Note Vega has a dramatic change to +478 now.

Looking at the overall portfolio chart and Greeks, it still favors a market pull back, as the Delta is -58 and Vega is 387 which creates value if Vix increases. While the adjustment helped to recenter the portfoltio, it narrowed down the profitable zone as well. Due to the close expiration date, I will start to exit positions if market continues to rise without stopping in the next few days.

Tuesday, January 29, 2013

Wednesday, January 23, 2013

Reducing Feb portfolio delta

After yesterday's adjustment on SPX positions, the market continued to rise. Today, the portfolio had reached a Delta of -95. I considered it as too high for my portfolio. It had more than doubled the value of 36 for initial portfolio positions as I analyzed before, even though the current portfolio margin was about twice as the starting margin. So I reviewed existing positions and decided to close out the following IC which had its price close to the right drop-off point and a Delta of about 20.

After closing this IC with a minor profit, the overall portfolio still has a Delta of -75. The remaining Vega is about -325, equivalent to a Delta of 30 at the moment. Thus the effective Delta is around -45. I'll see how market does tomorrow to decide if any further action is required.

After closing this IC with a minor profit, the overall portfolio still has a Delta of -75. The remaining Vega is about -325, equivalent to a Delta of 30 at the moment. Thus the effective Delta is around -45. I'll see how market does tomorrow to decide if any further action is required.

Tuesday, January 22, 2013

Iron condor trade adjustments to keep portfolio non-directional

With 23 days to SPX Feb option expiration, the SPX position P&L chart showed its price reached the adjustment point, since the market continued to push higher. Because the market has not pulled back for a while, I expected it to have a good chance to do that. So I decided to adjust only for the offending IC portion of the SPX positions.

To keep a similar profit potential, I had to increase the position size a bit. When playing with the 20 point wide and 10 point wide IC's of SPX on each side, I realized that the 10 point wide IC offered higher ROM (3.10/10=31% vs 5.15/20=26%). So I sold more 10 point wide IC on each side and closed the offending IC. In reality, it took a while to get the offending IC to be filled at 10 cents higher than the mid price of the IC.

The adjusted portfolio still have relatively high negative Delta, indicating the bias to a market pullback for it to become more profitable.

To keep a similar profit potential, I had to increase the position size a bit. When playing with the 20 point wide and 10 point wide IC's of SPX on each side, I realized that the 10 point wide IC offered higher ROM (3.10/10=31% vs 5.15/20=26%). So I sold more 10 point wide IC on each side and closed the offending IC. In reality, it took a while to get the offending IC to be filled at 10 cents higher than the mid price of the IC.

The adjusted portfolio still have relatively high negative Delta, indicating the bias to a market pullback for it to become more profitable.

Saturday, January 19, 2013

What lessons can we learn from failed paper trades

Since the completion of initial January non-directional option income paper portfolio on 11-20, SPX has risen from 1350 to 1480 on last Thursday, a 130 points or a 9.6% rise in about 2 months. The paper portfolio finally ended on 1-17, the index option expiration day, with major losses.

After the initial exit 13 days before expiration, the paper portfolio had an upper break-even point of 1470 and delta of -24, when SPX was at 1450. On Saturday Jan 5, SPX had risen 16 points to 1466. The P&L chart indicated either adjustment or closure actions had to be taken with about 11 days to expiration.

To continue my adjustment strategy tests, I placed a couple of butterfly adjustment trades which got filled the next Monday morning. The balanced butterfly, which was not expensive in my opinion, extended the upper BE by 5 or 6 points, reduced delta by 3 points. I thought the rising market was close to a retracement since it was in overbought condition. The new P&L chart is shown below.

The best time to close all positions after that was probably 1-7 where SPX dropped for a couple of days. This is also evident in my trade log by trading dates here. But I let the remaining positions to the expiration date and then closed out all positions with a major loss.

So, what can we learn from this failed paper portfolio this month, even if it was a dramatic rise in years for SPX?

After the initial exit 13 days before expiration, the paper portfolio had an upper break-even point of 1470 and delta of -24, when SPX was at 1450. On Saturday Jan 5, SPX had risen 16 points to 1466. The P&L chart indicated either adjustment or closure actions had to be taken with about 11 days to expiration.

To continue my adjustment strategy tests, I placed a couple of butterfly adjustment trades which got filled the next Monday morning. The balanced butterfly, which was not expensive in my opinion, extended the upper BE by 5 or 6 points, reduced delta by 3 points. I thought the rising market was close to a retracement since it was in overbought condition. The new P&L chart is shown below.

The best time to close all positions after that was probably 1-7 where SPX dropped for a couple of days. This is also evident in my trade log by trading dates here. But I let the remaining positions to the expiration date and then closed out all positions with a major loss.

So, what can we learn from this failed paper portfolio this month, even if it was a dramatic rise in years for SPX?

- Adjustment strategy: I have identified one improper adjustment strategy of butterfly in a prior post.

- Exit time: It's best to exit before 10 days to expiration when there is a chance (regardless of profits).

- Handling trading error: If trading errors like improper adjustments are identified for current month, the expected return of the month should be reduced. This means the portfolio should be closed sooner than usual. I'll creat a rule to handle trading errors in my system.

Monday, January 14, 2013

How SPX Vega changes with volatility and prices

I had studied how Vega (and other Greeks) changes with time in a previous post. Now I'd like to analyze how Vega changes with volatility and stock prices, since I'm using Vega to hedge the Delta in my monthly income portfolio selling high probability options, such as the Feb portfolio consisted of iron condors. With the help of TD Ameritrade's ThinkOrSwim analyzer, I captured the following image today to analyze my Vega changes with volatility and prices.

A picture is worth one thousand words. I have to digest this picture later when I have more time. For now, it looks to me the following is generally true in this picture. Note this is about the portfolio Vega, not the Vega of straight options.

The change of portfolio Vega described in this post also shows its conformance to the Vega changes of the straight options of calls and puts. For straight options, the Vega has the following characteristics in general.

A picture is worth one thousand words. I have to digest this picture later when I have more time. For now, it looks to me the following is generally true in this picture. Note this is about the portfolio Vega, not the Vega of straight options.

- When IV increases 1%,

- Absolute(Vega) changes (decreases) about 7.5% at current price and VIX levels;

- Absolute(Vega) changes (reduces) relatively larger at far far OTM strikes;

- Vega changes little around break-even points;

- Vega is most negative at the center of the portfolio P&L chart.

The change of portfolio Vega described in this post also shows its conformance to the Vega changes of the straight options of calls and puts. For straight options, the Vega has the following characteristics in general.

- Vega vs time: Vega is higher when option has more time (shown in volatility skew of expiration cycles or Vega has time decay too!).

- Vega vs price: Vega (All Greeks except Delta) is highest for ATM options.

- Vega vs volatility: The higher the volatility, the higher the Vega? Not necessarily!

- Vega is the option's sensitivity to its implied volatility and not directly proportional to volatility. Although the volatility values are higher for OTM put option strikes (shown in volatility skew of strikes), the option's sensitivities to IV for OTM options are lower, i.e. the Vega of OTM options is lower than that of the ATM options. However, for the same option strikes, Vega is higher if IV is higher.

Sunday, January 13, 2013

4th Quarter Adjustment Trade Review for High Probability Portfolio

As part of the trading process, I need to review past trades regularly to improve future performance. Today, I analyzed the past trade adjustments from an option adjustment strategy and SPX price level perspective using the following color coded graph.

The green box indicates the starting portfolio until 1st adjustment for each month. Other colored box represents strategies such as (multiple) calendars, IC (iron condor), vertical spread, butterfly, ETF trades. The blue oval indicates position exits.

It looks like the October portfolio was the lucky one offered by the market which ended at the same level as the start by SPX price. The double calendar adjustment worked perfectly for the month.

For November portfolio, it looks like the IC rolling up adjustment on 10-17 belongs to over-adjustment and the IC roll should have been risen to the point where the deficit was reset by the profit from closing of the put spread. If one of the above errors was not there, the portfolio would have ended much better. I think I was tricked by the stronger volume advances of the market for a couple of days at the time of the IC roll, even though the market did not reach confirmed uptrend state yet. I somehow mishandled the IC rolling rules at that moment.

For December portfolio, there were quite a number of adjustments (may be over-adjustments?). The 1st calendar adjustment on 11-15 started when portfolio Delta was 22 only and this adjustment was one sided calendar (Usually multiple calendars are required to maintain smoother P&L curve). The butterfly adjustments, including the one on 12-04, and the unbalanced butterfly on 11-29 seemed to offer little changes to the Delta.

Although it was a profitable quarter, I still need to sharpen my rules on adjustment points and the associated strategies.

The green box indicates the starting portfolio until 1st adjustment for each month. Other colored box represents strategies such as (multiple) calendars, IC (iron condor), vertical spread, butterfly, ETF trades. The blue oval indicates position exits.

It looks like the October portfolio was the lucky one offered by the market which ended at the same level as the start by SPX price. The double calendar adjustment worked perfectly for the month.

For November portfolio, it looks like the IC rolling up adjustment on 10-17 belongs to over-adjustment and the IC roll should have been risen to the point where the deficit was reset by the profit from closing of the put spread. If one of the above errors was not there, the portfolio would have ended much better. I think I was tricked by the stronger volume advances of the market for a couple of days at the time of the IC roll, even though the market did not reach confirmed uptrend state yet. I somehow mishandled the IC rolling rules at that moment.

For December portfolio, there were quite a number of adjustments (may be over-adjustments?). The 1st calendar adjustment on 11-15 started when portfolio Delta was 22 only and this adjustment was one sided calendar (Usually multiple calendars are required to maintain smoother P&L curve). The butterfly adjustments, including the one on 12-04, and the unbalanced butterfly on 11-29 seemed to offer little changes to the Delta.

Although it was a profitable quarter, I still need to sharpen my rules on adjustment points and the associated strategies.

Thursday, January 10, 2013

Adjusted RUT Iron Condor for Feb Income Portfolio

Market did not make meaningful retracement in the last few days. The RUT 880/900C to 780/760P IC initiated on 12-26 has its price near the right drop-off point. It's apparent from the overall RUT position P&L chart as shown below.

So I rolled the IC up for $6.60 credit after closing the original IC for $9.60. Then I added another half sized IC for $3.40 to make up the deficit. It increased the margin by $1000. The new portfolio chart looks pretty good for this market I think, even though it has a delta of -31 vs Vega of -350.

In analyzing potential adjustments, I played with calendars of multiple strikes and found the calendar spread adjustments would offer more Delta, but less Theta at this time (35 days to expiration). So I did not use calendars even if I think the volatility VIX is relatively low at around 13 (not much down side potential for VIX).

On my IWM bull diagonal spread, the short strike Jan$86 has its Delta reaching to 0.75, so I rolled it up to Feb$89c of Delta 0.33.

So I rolled the IC up for $6.60 credit after closing the original IC for $9.60. Then I added another half sized IC for $3.40 to make up the deficit. It increased the margin by $1000. The new portfolio chart looks pretty good for this market I think, even though it has a delta of -31 vs Vega of -350.

In analyzing potential adjustments, I played with calendars of multiple strikes and found the calendar spread adjustments would offer more Delta, but less Theta at this time (35 days to expiration). So I did not use calendars even if I think the volatility VIX is relatively low at around 13 (not much down side potential for VIX).

On my IWM bull diagonal spread, the short strike Jan$86 has its Delta reaching to 0.75, so I rolled it up to Feb$89c of Delta 0.33.

Labels:

Adjustment,

diagonal spread,

double calendar spread,

iron condor,

position trade,

RUT,

VIX

Wednesday, January 9, 2013

IYR Diagonal Rolled up to Feb

As market continues to show bullish signs, IYR rose steadily in the last week or so. I added another quarter position size to my IYR diaogonal spread holdings on Jan 2, after the big breakout. It doubled my position size on IYR since end of November, 2012. Now the Jan$66c has delta over 0.65, so I rolled it out to Feb$68c. I did not create any naked IYR position yet, due to the overbought condition. I'm looking for a pullback to close some short positions if market offers me a chance.

Created with ProphetCharts®

Sunday, January 6, 2013

Analysis of Jan Paper Portfolio Option Trades

On Jan 2 which was the first trading day of 2013, market responded to the news of resolution of the fiscal cliff. The Jan market neutral paper portfolio got hammered. Its delta reached -78 as shown below.

With about 13 days to expiration, I decided to start exiting positions. So I closed most positions that had little or negative Theta, leaving the positions that had good Theta untouched.

The portfolio had gone through 5 adjustments since its completion around 11-20 as shown in the image below. There were 2 times that SPX rose 30 points that caused adjustments.

There was a major mistake in the first adjustment with butterfly spread on 12-1, due to its lack of delta. Regular Butterfly adjustments, although very cheap, are suitable for late adjustment only since their P&L change mostly in the last 7 days. Note unbalanced butterflies, which cost more, are good for late adjustments in up-trending markets as well, even if their values start to change earlier (2 weeks to expiration) than that of the regular butterflies as analyzed before.

This adjustment error was partially caused by the unbalanced butterfly adjustment to my real portfolio which occurred one day before and made me addicted to butterflies rather than other proper strategies.

If I had adjustments that had reduced enough Delta around 11-30 and kept enough profit potential, then it would be most likely to close the portfolio around 12-27 when market pulled significantly.

With about 13 days to expiration, I decided to start exiting positions. So I closed most positions that had little or negative Theta, leaving the positions that had good Theta untouched.

The portfolio had gone through 5 adjustments since its completion around 11-20 as shown in the image below. There were 2 times that SPX rose 30 points that caused adjustments.

There was a major mistake in the first adjustment with butterfly spread on 12-1, due to its lack of delta. Regular Butterfly adjustments, although very cheap, are suitable for late adjustment only since their P&L change mostly in the last 7 days. Note unbalanced butterflies, which cost more, are good for late adjustments in up-trending markets as well, even if their values start to change earlier (2 weeks to expiration) than that of the regular butterflies as analyzed before.

This adjustment error was partially caused by the unbalanced butterfly adjustment to my real portfolio which occurred one day before and made me addicted to butterflies rather than other proper strategies.

If I had adjustments that had reduced enough Delta around 11-30 and kept enough profit potential, then it would be most likely to close the portfolio around 12-27 when market pulled significantly.

Labels:

Adjustment,

butterfly,

Errors,

Paper trade,

trade review

Saturday, January 5, 2013

Comparison of double diagonal spread and double calendar spread

In order to analyze adjustment strategies for my market neutral portfolio, I revisited the double diagonal spread which favors up-trending market when compared to double calendars. This time, I analyzed the out-of-the-money spreads with TOS analyzer and would like to document it and share with other option strategy players.

In a nutshell, double diagonal spreads when compared with double calendars of similar strikes and short option month, have the following characteristics:

- Lower sensitivity (Vega) to implied volatility (10% lower in the example)

- Faster time decay

- Lower Delta which makes it less susceptible for directional changes

- Higher profit potential (7% higher in the example), but less ROR

- High margins vs no margins for DC

The margin requirement for double diagonal is the initial debit plus the strike differences at the call side and at the put side.

The DD and DC has very similar break-even points and probability of success in the analyzed trades as shown in my document here which includes P&L graphs under different scenarios (time and volatility changes) for both strategies. As the position size increases, DD will show substantially more Vega benefits in IV falling markets.

Note the DD also allows more complex-ed adjustment strategies of its own with option rolling.

The DD and DC has very similar break-even points and probability of success in the analyzed trades as shown in my document here which includes P&L graphs under different scenarios (time and volatility changes) for both strategies. As the position size increases, DD will show substantially more Vega benefits in IV falling markets.

Note the DD also allows more complex-ed adjustment strategies of its own with option rolling.

Thursday, January 3, 2013

Feb monthly income option portfolio adjustment

Market had responded to the fiscal cliff and other economical news with 60 points rise in SPX in the last couple of days. It caused the market neutral option portfolio some damages. With the price reaching right shoulder of the P&L curve, adjustments are required.

With about 42 days to expiration, I still have time for rolling up the iron condors for Feb. So I rolled all the SPX IC's upper for a debit around $3.00 and added a 10 point wide SPX IC for a credit around $3.00 to make up the deficit. On the RUT side, I rolled up one IC only, since the price was close to the drop-off point on the right side but not passed it. The roll up also had a deficit around $3.00 which was made up by adding another 10 point wide IC. The new portfolio P&L curve is shown below.

With these adjustments, I tried to keep the original max profit potential. I will continue to adjust if necessary.

I also adjusted my paper portfolio yesterday and will document it when I have time tomorrow. On the bullish position trades, I also rolled up some strike prices and added new position sizes.

With about 42 days to expiration, I still have time for rolling up the iron condors for Feb. So I rolled all the SPX IC's upper for a debit around $3.00 and added a 10 point wide SPX IC for a credit around $3.00 to make up the deficit. On the RUT side, I rolled up one IC only, since the price was close to the drop-off point on the right side but not passed it. The roll up also had a deficit around $3.00 which was made up by adding another 10 point wide IC. The new portfolio P&L curve is shown below.

With these adjustments, I tried to keep the original max profit potential. I will continue to adjust if necessary.

I also adjusted my paper portfolio yesterday and will document it when I have time tomorrow. On the bullish position trades, I also rolled up some strike prices and added new position sizes.

Subscribe to:

Posts (Atom)