With about 13 days to expiration, I decided to start exiting positions. So I closed most positions that had little or negative Theta, leaving the positions that had good Theta untouched.

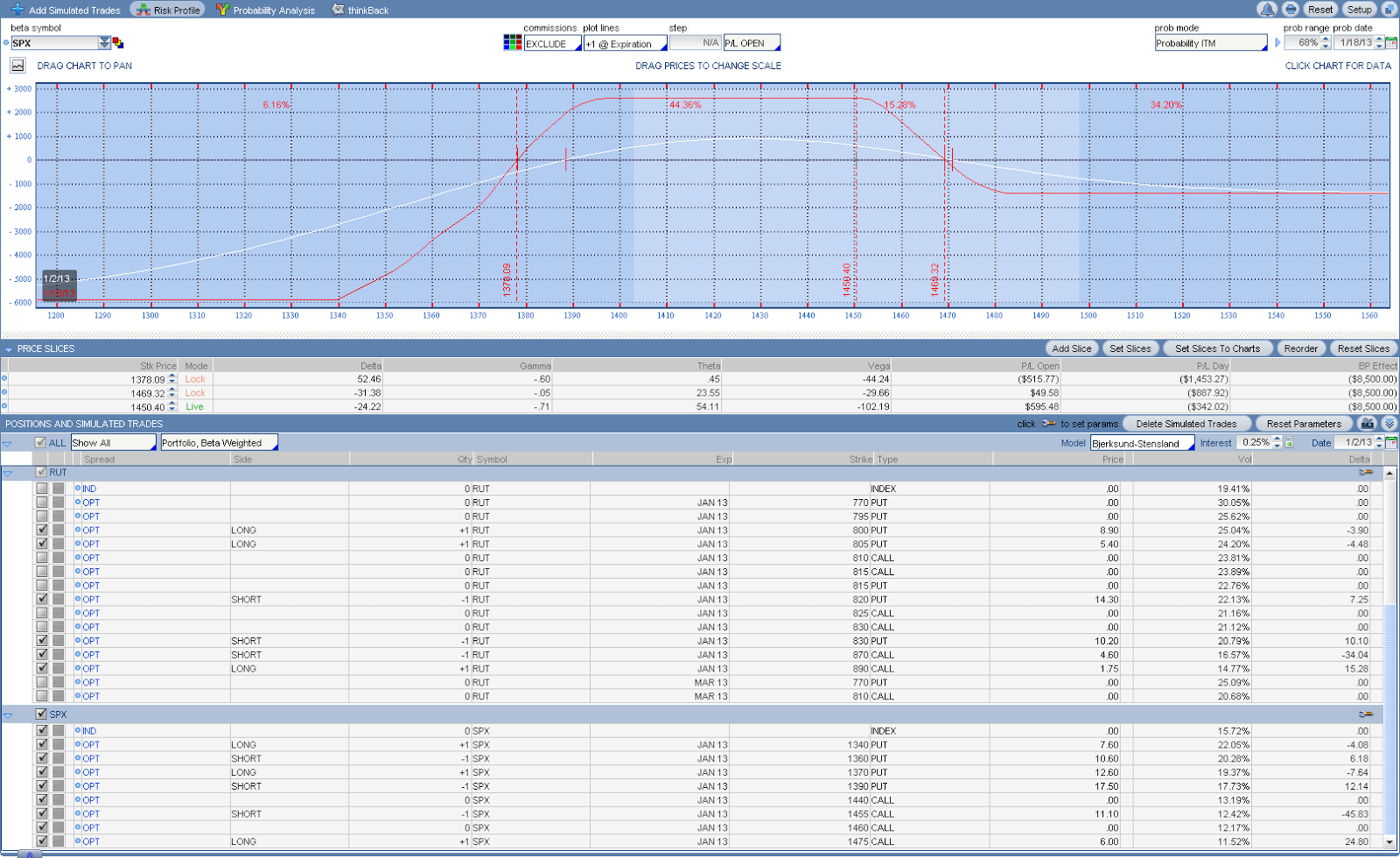

The portfolio had gone through 5 adjustments since its completion around 11-20 as shown in the image below. There were 2 times that SPX rose 30 points that caused adjustments.

There was a major mistake in the first adjustment with butterfly spread on 12-1, due to its lack of delta. Regular Butterfly adjustments, although very cheap, are suitable for late adjustment only since their P&L change mostly in the last 7 days. Note unbalanced butterflies, which cost more, are good for late adjustments in up-trending markets as well, even if their values start to change earlier (2 weeks to expiration) than that of the regular butterflies as analyzed before.

This adjustment error was partially caused by the unbalanced butterfly adjustment to my real portfolio which occurred one day before and made me addicted to butterflies rather than other proper strategies.

If I had adjustments that had reduced enough Delta around 11-30 and kept enough profit potential, then it would be most likely to close the portfolio around 12-27 when market pulled significantly.

No comments:

Post a Comment