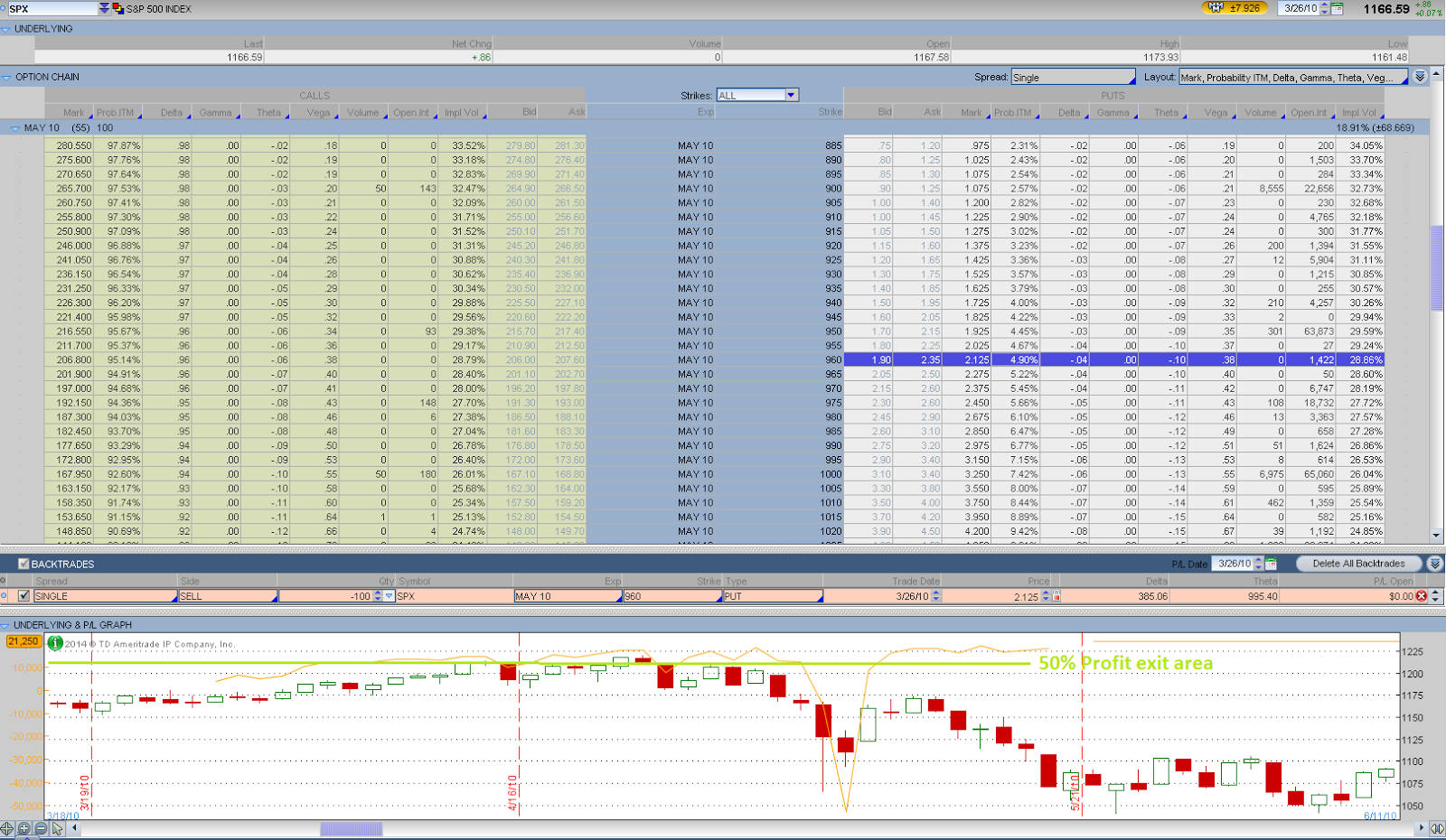

Karen uses a unique method to manage the allocated

trading capital. She pretends the market dropping over 12% in her margin crash

tests while TOS portfolio policy stated a minimal 10% drop for portfolio margin

using broad index based vehicles. Using the TOS analyzer, she watches potential

crash loss in the portfolio against the net liquidation value of her account as

shown in the following picture. On the Analyzer tab, the daily P&L numbers

at 10% up and 12% down must not exceed net liquidation value.

In the above chart, the +6% and the -10% slices are

broker SPX stress test prices. All the other slices beyond them are Karen’s

stress test points. In order to maintain sufficient adjustment capital during

market sell-offs, Karen lowers her stress test point below the 10% down point

by another 100 to 200 offset points, depending on the long term market volatility

condition.

- · 2013 Crash price (cushion) = (Current price – 100) x 88% due to lower volatility.

- · 2011 crash price = (current price – 200) x 88% due to higher volatility.

According to Figure 2: SPY and Its Implied Volatility Since 2008 shown before, there are 2 levels of IV in the past few years. Starting

at January of 2013, the volatility made a lower low and stayed within a much

narrow and lower channel ever since. Thus, it makes sense to use the smaller

and pretended drop of 100 points of SPX in the crash price calculation starting

at the beginning of 2013.

In my personal opinion, it will be a good time to

switch to the larger drop of 200 points of SPX when the IV makes a higher low

and forms a newly elevated channel in the future. If the volatility VIX is

generally lower to a level of 11 and 12 at its bottom (this is a long bull

market condition), the 100-point offset is used. If the volatility is higher to

a level of 13 at the bottom of the VIX, the 200-point offset is used.

Additionally, it is easier in the TOS analyzer and

more conservative if a Karen style trader uses the following formula to

determine the crash price. Karen does not offer complete details of her trading

system but encourages traders to come up with the system that they are

comfortable with.

- · crash price = current price x 88% - 100 or 200

According to the statements in the interview, the

12% crash down price has a probability of ITM of 5% approximately. Let’s

investigate it using today’s data as a specific example. The SPX price is 1900

on May 25, 2014. The 12% down SPX price based on Karen’s stress test formula is

1584. There is a 53 DTE July 1585 put option of ITM probability of 2%. Although

the probability to expire ITM on July expiration date is quite low, the

probability to touch the strike of 1585 is a bit higher, probably twice the

amount of expiration probability to 4 to 10%.

Now, we can study the margin requirement and its

changes for the hypothetical position shown in the above chart. It’s clear that

the opening or initial margin requirement is $6,291. The “Explain Margin”

section embedded in the chart indicates the margin requirement changes from

-10% to +6% of SPX price changes.

However, if SPX drops to 1565, a level looked by Karen

style trader, the loss would be $19,968. Karen would make sure the loss number

is less than the net liquidation value of the account on the opening day with

the proper size of contracts. This amount of the loss would be higher than the

initial margin requirement of $6,291. As of today, I’m not sure what would the

new margin requirement be in this scenario. Would it become 4.9 times of the

initial margin requirement to $30,869? How margin requirement changes in market

crash conditions still needs investigation in the future.

Although the PM requirement changes according to

market conditions for existing portfolio and the changes may be different for

various brokerage firms, the net liquidation value of an short option account

is more deterministic. Therefore, the net liquidation value is used as the

basis for comparing the daily P&L number in Karen style trading.

It should be noted that the initial margin $6,291 of

the position is dictated by the short call option at an upside movement of +6%

of SPX price as the down side movement of -10% requires a less amount of margin

of $6,266 only. It implies more puts can be sold in trade adjustments if market

tanks, because short put options require significant less margins. This is naturally

helpful to obtain more credits to cover the deficit of put option rolling down

or out when market crashes.