Karen discussed

the flash crash day as a great day of option trading for her style. She

mentioned she had to give up profits for a few months to get into a safe

territory. Before the crash date, a portfolio of Karen style would have naked

options of the May (14 DTE) and June (42 DTE) cycles most likely. The May

options might be started more than 40 days ago in the last two weeks of March

following the 56 day rule to open trades. The June options might be started

over 14 days ago in the last 2 weeks of April.

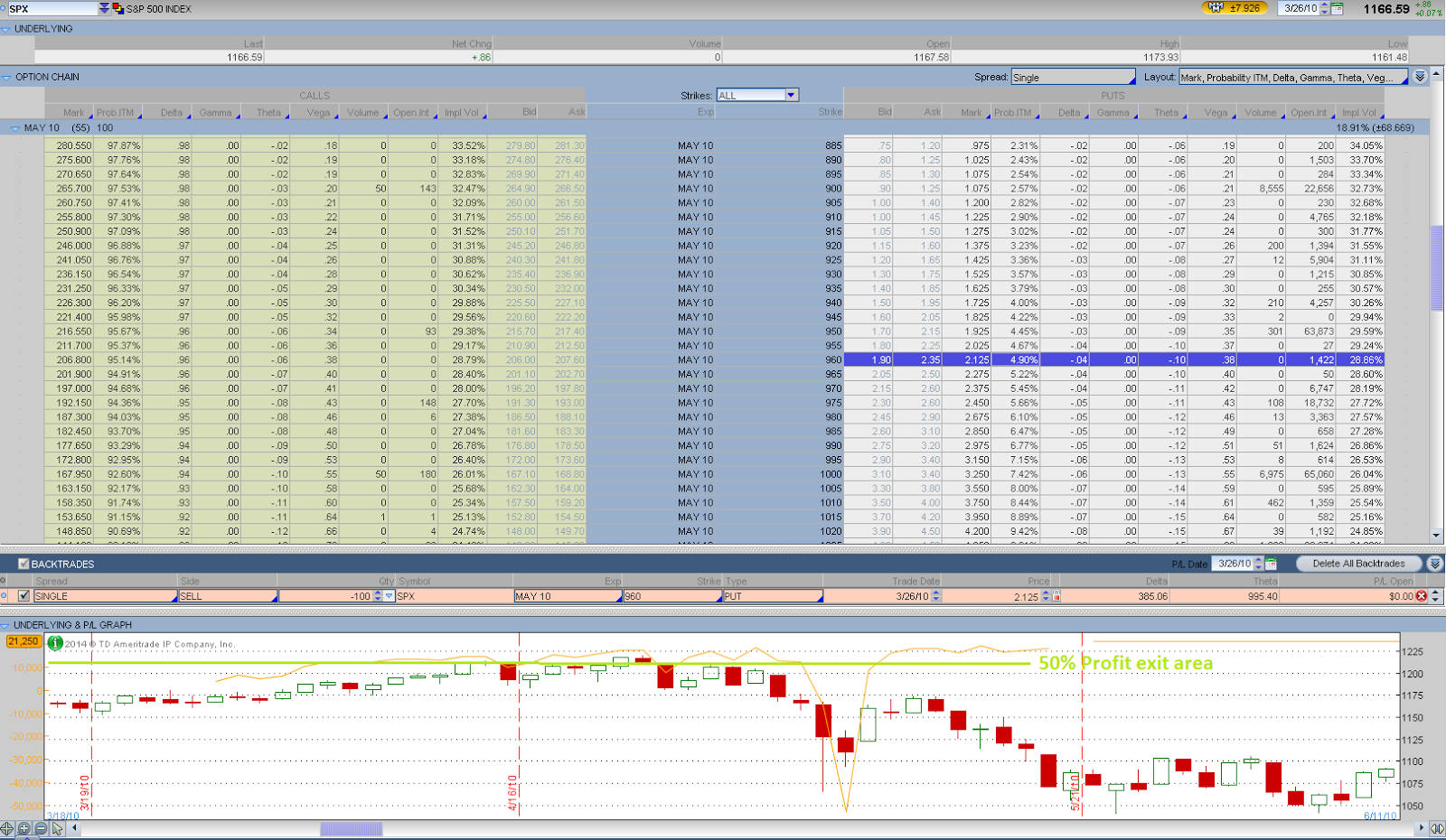

Let’s take a

look at the life of the May put options first. As marked in the above chart, March

25 was the 56 DTE. On the next market down day on March 26, we could sell SPX May

$960 put which had ITM probability of 4.90% for $2.13. However it was a bit

surprising that the actual trading volume for the strike was minimal. It looked

like Karen did not trade on that day. The option reached 50% profit zone in one

week or two. If we took profit following the rules in Section 5

Exit Rules and Winner Management,

then everything else would be simple for this position. Otherwise, it would be

a rough ride. On May 7 with 14 days to expiration, the put option price was $7.4

with ITM probability of 13.2%, about 3.5 times of the originally sold price. With

Karen’s winner management rules, the option would be let expire worthless for a

maximum profit since it might not reached the adjustment point. Overall, the

May put options did not appear to be in real danger when compared against June

put options at the flash crash according to this analysis.

Now, let’s study

the life of the June put options. There were 56 days to expiration for June

options on April 22, 2010. This day and the next day were up days for market as

shown in Figure 11:

SPX Daily Chart of Flash Crash of May 6, 2010.

So we could sell calls in these two days.

On April 27,

2010 the market dropped significantly and it was a good time to sell puts. We

could sell 100 contracts of June $935 put with a 4.88% ITM probability (Delta =

4) following Karen’s entry rules described in Section 3

Option Selection

and Section 4.1

Entry (Legged in) Rules.

The bid/ask prices were $2.00/$2.90 (middle price = $2.45) and the volume was

over 500.

Additionally, if

the some puts were sold some time before the close of market, the trade could

have seen June $950 strike having ITM probability at 5% (5.68% EOD) and sold

these contracts for a premium around $2.45. The end-of-day price became $2.90

for the strike which indicated a $0.45 loss on the day. By the way, the actual

volume of this specific put strike on the day was about 1.7K, the 2nd

largest quantity for OTM strikes of the day.

According to Figure 12:

The Life of a 5% ITM Probability Put Option Survived

the Flash Crash,

the June $950 put option’s ITM probability would have approached 30% at the

lowest point of the flash crash day. But

it was unlikely that it exceeded the 30% ITM probability too much, even if the

position losses could be 7 times of the original premium received. If the Karen

trader stayed calm, did not get scared by the big account loss at the moment

and followed the adjustment rules, there would be no need to adjust this

position.

However, most

retail traders are likely to get close to panic in the market crash environment,

because they would find a huge loss number at the profit and loss field of the

portfolio and figure out that the loss on paper would take many months to a

year to recover. They may start to forget about rules and disciplines and execute

special trades that would ruin the portfolio later on. Karen gave some help on

how to deal with such psychological issues as discussed in Section 8

Psychology and Mindset.

What are these sections you are referring to?

ReplyDeleteThis is a document work-in-progress. The sections are to be written in future.

DeleteThanks

Charles

You need to post this on the Elitetrader.com. There is a big Karen debate going on. This is good stuff

ReplyDeleteI visited the website before. Currently I'm busy with the Karen study group: https://groups.yahoo.com/neo/groups/supertraderkarenstudy/info. I think one of the major differences in the groups is that the study group is focused on understanding, analyzing and applying Karen's principles while the elite group has more diversified topics including the debates of validity of Karen and Tom.

Delete