The Delta of the my short XLE put strike July$76 fluctuated around 0.65 in the last couple of days as XLE was around $75 with about 16 DTE. I had placed the adjustment orders to close the existing position and sell Aug$70.5/66.5p for a credit of about $44 yesterday. But they were not filled.

Today, the Delta seemed to break down 0.65 level (which was my adjustment level) firmly as XLE traded near $74.4. Today, I found the IV for XLE actually dropped a bit even though XLE fell hard. Though this was not desirable for premium sellers, I still sold 41 contracts of Aug$70/66p vertical put spread which has 51 DTE with a credit of $0.43. The return was 10% which met my target. I did not sell the normal $5 width, because the Aug$65p had relatively wider bid/ask spread and the associated return would be under 10% target (credit of $0.48).

As I was waiting for my August vertical spread to be filled, I could see that the value of the closing July spread order was increasing faster than that of the August vertical. This was due the Gamma of the July vertical was larger. In the end, my August order was filled first and my July closing order was filled 30 minutes later with a debit of $1.73 as XLE prices pulled up.

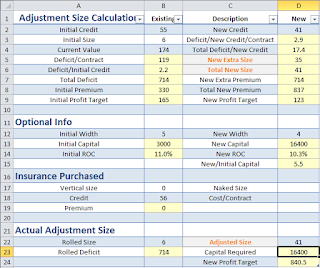

To determine the adjustment size, I used my spreadsheet. Basically I rolled out the July spread to August which gave me much more time to receive the desired profit. Again, the closing target is 50% of maximal potential profit of the spread which was described in a previous post. I had not bought any put as insurance at the moment. The rest of the portfolio (SPY) was behaving OK today. I intentionally hold off opening other positions to reduce the capital consumption as the adjustment used a lot of buying power.

No comments:

Post a Comment