Trading Rules

- Adherence consistency

- Skillful application/execution

- Monthly rule review/study

Market has told me the weak spot in my trading rules in September: Need to reserve extra time for trade adjustments. Currently, my system holds options till last 1 or 2 weeks before expiration. This is a fast time decay period but also risky due to lack of additional time in case trade adjustment is needed. In the past year, statistics kicked in most of times to favor fat profits in the last period of the cycle. However, there was only one time of September in which market would take away all those profits earned in the last period and it's a normal behavior for market statistics. If I had one or two more weeks for the options in September, the profits would have been kept safely. So I'll update my trading rules to make sure there is enough time to allow trade adjustment working in the last period of my monthly option cycle.

Psychology

- Action during uncertainty

- Risk Comfort ability/Adverse damage impact

- Trade anxiety

- Winning Altitude Development

I'll set up my rules so that I can take whatever P&L the market offers to reduce risks, instead of a fixed % of profit target. Winning consistency is a state of mind that excellent traders think in a way similar to below. The market offers endless opportunities month after month for theta seekers. Why worry about a couple of months that may not have profit. The high probably trades are guaranteed by statistics. The losses should be expected, the money management and adjustment rules guarantee limited damages. Trade to another month since there are always endless months to continue for profits. Even an average of 3% per month is an excellent achievement for a trader.

Trading Time

- Trading days

- Rest days

Trades and Market Replay

- Market Forecast

- Trades and Adjustments

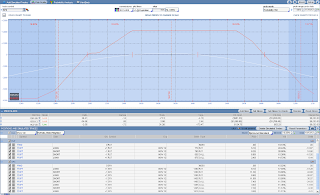

October high probability portfolio was a short and sweet cycle with just one adjustment to hedge the downside risk. Even though it turned out the market did not sell-off after the hedge immediately, the smooth portfolio still reached its target around 3 weeks after initial position.